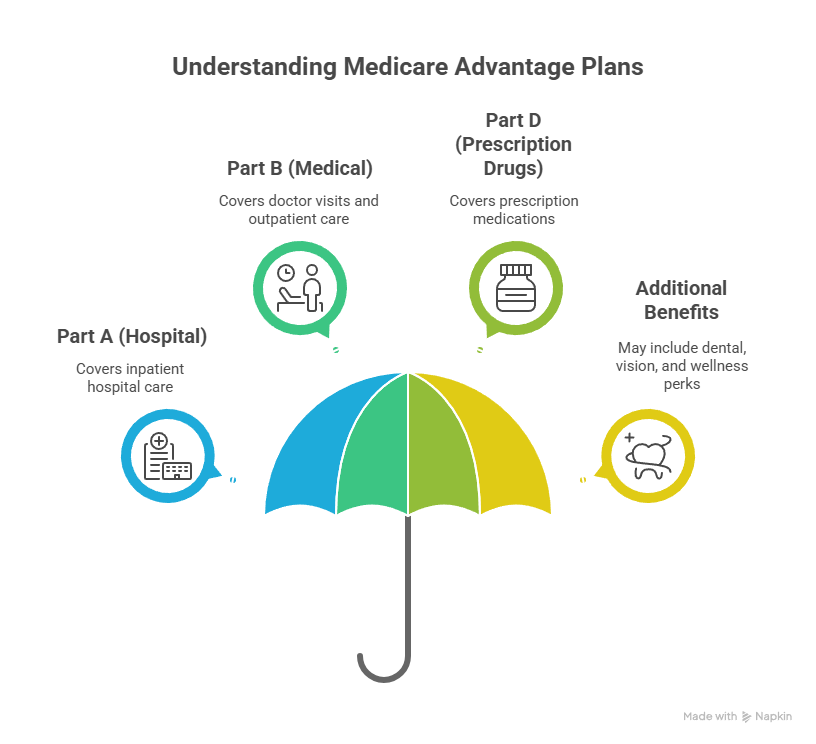

If you’re nearing 65 or already enrolled in Medicare, you’ve probably wondered about the advantages and disadvantages of using Medicare Advantage plans. Referred to as Part C, these plans are offered through Medicare-approved private insurers. They combine Part A (hospital), Part B (medical), and often Part D (prescription drugs) — sometimes adding perks like dental, vision, and wellness benefits.

At Waters Edge Medical Clinic in St. Petersburg, Florida, we know your insurance choice can significantly affect your access to care. Let’s break down both the benefits and drawbacks so you can make a confident decision for your health and budget.

Advantages of Using Medicare Advantage Plans

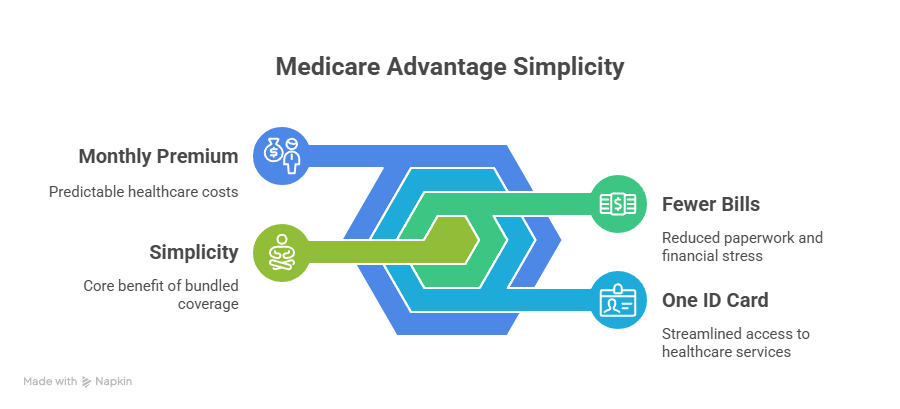

1. All-in-One Convenience

Instead of juggling multiple plans, a Medicare Advantage plan bundles your coverage under one insurer. That means fewer bills, one ID card, and one monthly premium. This simplicity appeals to many seniors who prefer straightforward management of their healthcare.

2. Extra Benefits You Don’t Get with Original Medicare

Most Medicare Advantage plans include services that Original Medicare doesn’t cover, such as:

- Routine dental and vision care

- Hearing aids

- Wellness programs and fitness memberships

- Transportation to medical appointments

These add-ons can save hundreds of dollars annually and make staying healthy more affordable.

3. Annual Out-of-Pocket Maximum

Unlike Original Medicare, Medicare Advantage plans have a yearly cap on out-of-pocket expenses. Once you hit that limit, the plan covers the rest of your approved medical costs — giving you predictable spending and peace of mind.

4. Low or Zero Premiums

Many people are surprised to learn that some Medicare Advantage plans offer $0 premiums (beyond your standard Part B payment). That can make coverage more affordable, especially for retirees on fixed incomes.

5. Coordinated Care Across Providers

Because Medicare Advantage plans often operate within a network, your care is more coordinated. This means your primary care provider, specialists, and hospital work together to streamline your treatment — reducing duplicate tests and improving outcomes.

6. Quality Ratings Help You Choose

Each plan receives a Star Rating from Medicare based on quality, customer satisfaction, and preventive services. Plans with four or five stars usually provide better care management and added benefits.

Disadvantages of Using Medicare Advantage Plans

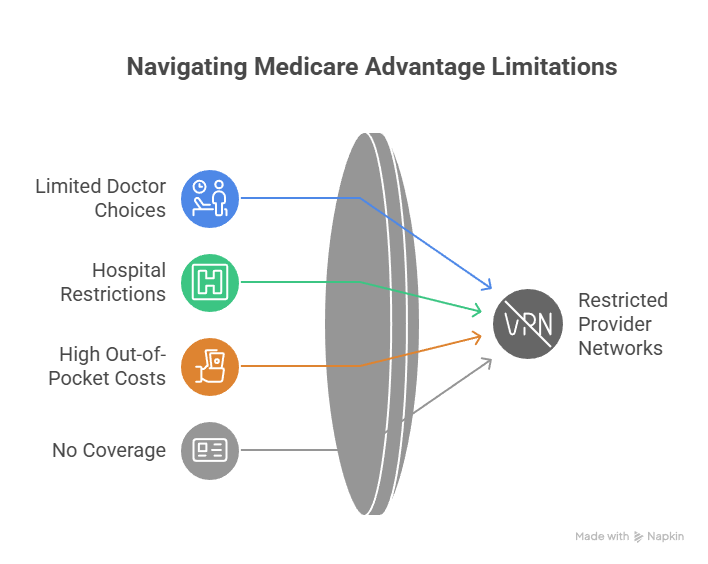

1. Limited Provider Networks

One of the biggest disadvantages of using Medicare Advantage plans is restricted provider networks. You may need to choose doctors or hospitals within your plan’s system. If your favorite specialist or facility isn’t covered, you could face high out-of-pocket costs or no coverage at all.

2. Prior Authorizations and Referrals

You may need to get approval in advance for certain treatments or to see a specialist under many Medicare Advantage plans. These delays can frustrate patients who need fast access to care — especially for time-sensitive treatments.

3. Plan Changes Every Year

Your plan’s network, premiums, and copays can change annually. A plan that fits your needs this year might not be the best option next year. That’s why it’s crucial to review your plan details during the Medicare Open Enrollment Period each fall.

4. No Medigap (Supplement) Option

If you enroll in Medicare Advantage, you can’t buy a Medigap plan to fill coverage gaps. If you later switch back to Original Medicare, you might not qualify for Medigap without going through medical underwriting.

5. Travel Restrictions

Original Medicare is accepted nationwide, but most Medicare Advantage plans limit you to a specific service area. This can be inconvenient for people who travel often or live part-time in another state.

6. Potential Coverage Denials

Since Medicare Advantage plans are managed by private insurers, there’s a chance of claim denials or delays in approval. While you can appeal decisions, it adds an extra layer of stress and paperwork.

7. Complex Comparisons

With thousands of plans available nationwide — each with different rules, drug lists, and benefits — comparing them can be confusing. It’s easy to miss small details that affect your future care costs.

Which Option Is Right for You?

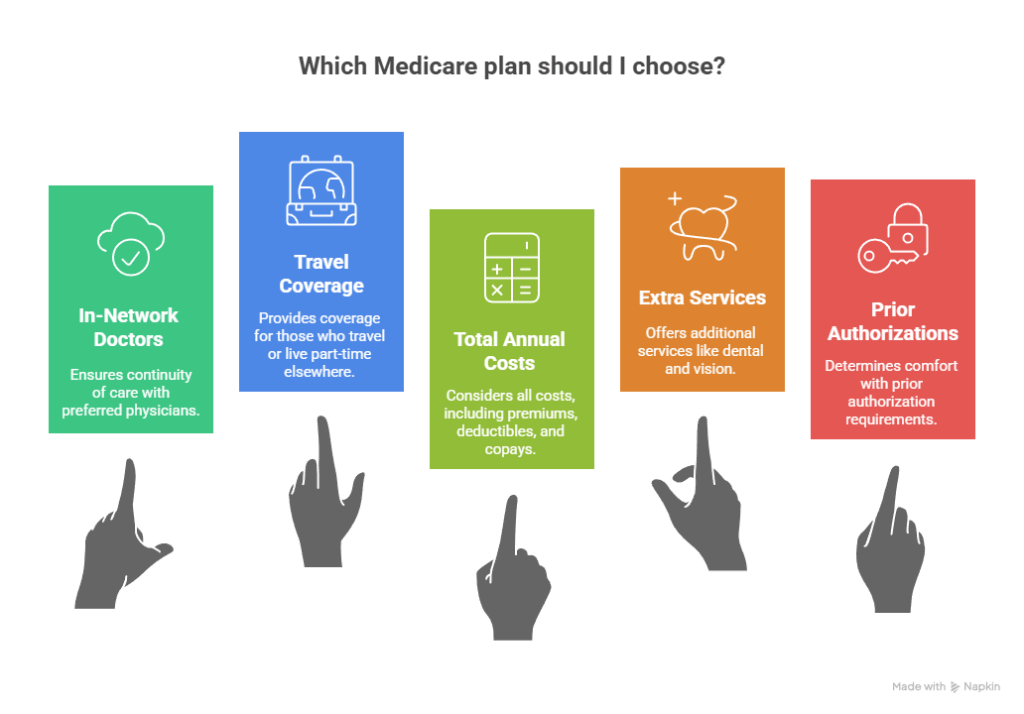

Before enrolling in a Medicare Advantage plan, ask yourself:

- Are my preferred doctors in-network?

Switching physicians can disrupt your ongoing care. - Do I travel or live part-time elsewhere?

Out-of-area coverage may be limited. - What are my total annual costs?

Look beyond premiums — consider deductibles, copays, and prescription coverage. - Do I need extra services like dental or vision?

If so, a Medicare Advantage plan could save you money compared to Original Medicare. - Am I comfortable with prior authorizations?

If you prefer more freedom, Original Medicare plus Medigap might suit you better.

Waters Edge Medical Clinic’s Perspective

At Waters Edge Medical Clinic, we often see how insurance decisions affect our patients’ care quality, accessibility, and costs. Here’s our advice:

- Check your provider network before enrolling.

- Understand prior authorization rules — especially if you need ongoing treatments.

- Review your plan annually during open enrollment.

- Ask questions early to avoid unexpected denials or coverage gaps.

Our team helps patients navigate insurance decisions every day, ensuring they receive the care they deserve — whether through Medicare, private insurance, or direct-pay options.

Final Thoughts

The advantages and disadvantages of using Medicare Advantage plans depend on your personal health needs, financial goals, and comfort level with managed care.

If you value extra benefits and lower upfront costs, a Medicare Advantage plan could work for you. If you prefer freedom to choose any doctor and fewer prior authorizations, Original Medicare with a Medigap plan may be a better fit.

At Waters Edge Medical Clinic in St. Petersburg, FL, we believe that informed patients make empowered choices. If you’re unsure which plan fits your needs best, reach out to our office — we’ll guide you through your options so you can prioritize your health and well-being.

Frequently Asked Questions About Medicare Advantage Plans

1. What sets Medicare Advantage apart from Original Medicare?

Original Medicare (Parts A and B) is run directly by the federal government, covering hospital and medical services.

Medicare Advantage (Part C) is offered by private insurance companies approved by Medicare. These plans bundle your hospital, medical, and often prescription drug coverage into one plan — sometimes adding extra perks like dental, vision, and hearing benefits.

However, Medicare Advantage plans usually have provider networks and prior authorization requirements, while Original Medicare lets you see any provider that accepts Medicare nationwide.

2. What are the biggest disadvantages of using Medicare Advantage plans?

The most common disadvantages of using Medicare Advantage plans include:

- Limited doctor and hospital networks

- Prior authorization requirements for many treatments

- Coverage that may not travel with you out of state

- Plan benefits and costs that change each year

- Inability to add a Medigap (supplemental) plan for extra protection

These can make it harder for some patients to access care when they need it most.

3. What are the main advantages of Medicare Advantage plans?

The key advantages of using Medicare Advantage plans include:

- Bundled coverage (hospital, medical, and sometimes prescription drugs)

- Added benefits like vision, dental, and hearing

- Predictable annual spending with an out-of-pocket maximum

- Lower or zero monthly premiums

- Coordinated care through a managed provider network

For many patients, these plans simplify healthcare management while reducing monthly costs.

4. Is Medicare Advantage cheaper than Original Medicare?

It depends on your personal health and usage.

Some Medicare Advantage plans offer $0 premiums, making them appear cheaper at first glance. However, out-of-pocket costs like copays, deductibles, and coinsurance can add up — especially if you see out-of-network doctors or need frequent care.

In contrast, Original Medicare with a Medigap policy might cost more monthly but can offer better protection from unexpected expenses.

5. Can I switch from Medicare Advantage back to Original Medicare?

Yes, you can switch during certain enrollment periods:

- Medicare Advantage Open Enrollment (Jan 1 – Mar 31)

- Annual Enrollment Period (Oct 15 – Dec 7)

During these windows, you can drop your Advantage plan, return to Original Medicare, and enroll in a standalone Part D prescription plan.

However, remember that getting Medigap coverage afterward may require medical underwriting unless you’re in a guaranteed-issue period.

6. Does Medicare Advantage cover vision, dental, or hearing?

Yes, many Medicare Advantage plans include these additional benefits, which Original Medicare does not cover.

You may get allowances for eyeglasses, hearing aids, or dental cleanings — but the coverage amount and provider network can vary widely.

Always check plan details to ensure those benefits meet your needs.

7. Can I use Medicare Advantage anywhere in the U.S.?

Usually, no.

Medicare Advantage plans have specific service areas — typically tied to a state or county. You may only have full coverage when receiving care within your network or region.

If you travel frequently or live in multiple states (for example, as a snowbird between Florida and another location), Original Medicare may offer better flexibility.

8. Who should consider a Medicare Advantage plan?

A Medicare Advantage plan may be right for you if:

- You want one comprehensive plan that includes all your healthcare services.

- Your doctors are in-network.

- You want dental, vision, and fitness perks.

- You rarely travel outside your local area.

- You prefer lower premiums and can manage copays or authorizations.

If freedom of provider choice or predictable costs matter more to you, you might prefer Original Medicare with a Medigap plan.

9. How do I know which Medicare Advantage plan is best for me?

Start by comparing:

- Provider networks (Are your doctors covered?)

- Drug formularies (Are your prescriptions affordable?)

- Out-of-pocket limits (What’s your annual spending cap?)

- Star Ratings (How well does the plan perform overall?)

At Waters Edge Medical Clinic in St. Petersburg, we often help patients understand how their insurance choices affect their access to care. If you need guidance, our team can review your plan options and explain how they align with your health needs.

10. Can Waters Edge Medical Clinic help me with my Medicare Advantage plan?

Absolutely.

Our team at Waters Edge Medical Clinic can help you:

- Understand your coverage and benefits

- Determine if your provider is in-network

- Navigate prior authorizations

- Review new plans during open enrollment

- Ensure you’re getting the care and support you deserve

We believe in empowering patients through education, not sales. Our goal is to help you make the best choice for your health — and your peace of mind.

Ready to Learn More?

If you’re exploring Medicare Advantage plans in St. Petersburg, FL, and want to understand how they compare to traditional Medicare, call Waters Edge Medical Clinic today.

Our friendly staff can guide you through the pros and cons so you can make a confident decision about your care.